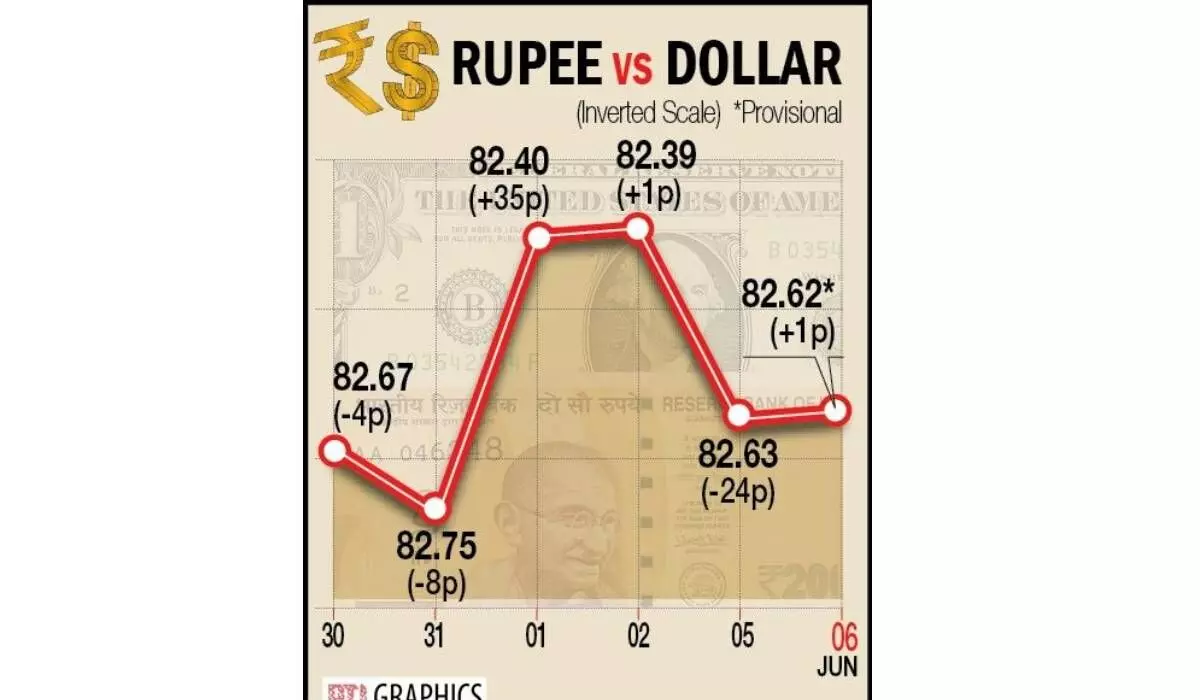

Re closes on a flat note at 82.62/USD

RBI’s monetary policy later this week and strengthening Greenback in global forex markets are pressure builders for local unit

image for illustrative purpose

Mumbai The rupee consolidated in a narrow range to settle just one paisa higher at 82.62 against the US dollar on Tuesday amid a muted trend in domestic equities.

The rupee is trading in a narrow range as market participants are vigilant ahead of the RBI’s monetary policy later this week. The central bank is widely expected to leave the repo rate unchanged at 6.5 per cent. A strengthening greenback in the international markets also kept pressure on the domestic unit, forex traders said. At the interbank foreign exchange market, the local unit opened at 82.56 against the US dollar and settled at 82.62, up one paisa over its previous close. During the day, the domestic unit witnessed an intra-day high of 82.56 and a low of 82.66. On Monday, the rupee closed at 82.63 against the US currency.

The dollar index, which gauges the greenback's strength against a basket of six currencies, rose 0.12 per cent to 104.12. Global oil benchmark Brent crude futures declined 1.60 per cent to $75.48 per barrel. Forex traders said the Reserve Bank's rate-setting monetary policy panel began deliberations on Tuesday. Headed by Reserve Bank Governor Shaktikanta Das, the six-member Monetary Policy Committee (MPC) will meet for three days and the decision would be announced on Thursday.

On the domestic equity market front, the 30-share BSE Sensex advanced 5.41 points or 0.01 per cent to end at 62,792.88 points, and the broader NSE Nifty rose 5.15 points or 0.03 per cent to 18,599.00 points. Foreign Institutional Investors (FIIs) were net sellers in the capital market on Monday as they offloaded shares worth Rs700.98 crore, according to exchange data.